Dual Eligible Special Needs Plans: Frequently Asked Questions (FAQs) for Members

Read FAQs about Dual Eligible Special Needs Plans.

What are Medicare and Medicaid?

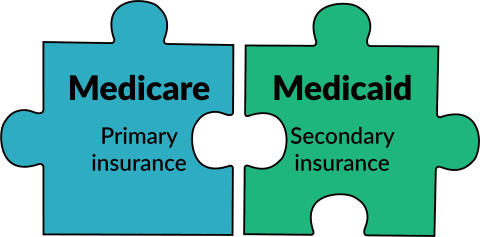

You can have both Medicare and Wisconsin Medicaid for health insurance.

Medicare is a federal health insurance program for people who:

- Are 65 or older.

- Have certain disabilities.

- Have advanced kidney disease.

Medicaid provides health care coverage, long-term care, and other services to Wisconsin residents. Wisconsin Medicaid helps pay for costs that Medicare doesn’t cover. There are many types of Medicaid programs. Each program has different rules you must meet to get coverage. Some of these relate to age and income level.

There are two ways to get Medicare: Original Medicare or Medicare Advantage.

Original Medicare is a federal health insurance program that requires a separate insurance plan to cover prescription drugs (called Part D). You can also buy a Medigap (also called a Medicare Supplement policy) to help cover costs.

Medicare Advantage (also called Part C) plans must cover everything that Original Medicare covers, but they can charge different amounts for services. Medicare Advantage plans have networks, which means your doctor must accept your plan’s insurance to have your bills covered.

If you have a Medicare Advantage plan, you’re still a Medicare member. Instead of getting your coverage from the federal government, though (like you do with Original Medicare), you get it from a private company. The government contracts with private health insurance companies to provide Medicare this way.

What are Dual Eligible Special Needs Plans?

A Dual Eligible Special Needs Plan, also called a D-SNP, is a kind of Medicare Advantage plan for people who have both Medicare and Medicaid.

D-SNPs cover hospital, medical, and prescription costs—all in one plan, with little or no costs. The plans have provider networks. You must see doctors who are in your network (meaning they accept your insurance) to have your bills covered.

D-SNPs work best when you’re enrolled in the same company’s HMO (health maintenance organization) for Medicaid. That way, the same company provides both your Medicare and Medicaid coverage.

Medicare and Medicaid usually don't coordinate. Separate companies provide managed care for each plan.

If you have a Medicare D-SNP and Medicaid health maintenance organization (HMO) or managed care organization (MCO) through the same company, Medicare and Medicaid benefits are coordinated.

You must have both Medicare and Medicaid to get a Dual Eligible Special Needs Plan. Your plan options will depend on what type of Medicaid you have.

To find out which plans are available in your area:

- Call Medicare at 800-633-4227.

- Visit Medicare.gov.

- Visit our Dual Eligible Special Needs Plans page.

Is a D-SNP plan right for me?

D-SNPs only cover your health care costs if the doctors you see are in your plan’s network. You can find out by calling the plan or checking online.

You may need a referral from your doctor to see a specialist.

You can check to see if your prescriptions will be covered and if you can keep using the same pharmacy by:

- Calling the plan.

- Checking Medicare.gov.

- Checking the plan’s formulary on their website.

You can get help coordinating your Medicare and Medicaid benefits. You can also get other benefits, including:

- Dental coverage.

- Hearing devices.

- Over-the-counter prescription drugs and products.

- Vision coverage.

Enrolling in a D-SNP doesn’t guarantee extra benefits, though. Call the plan or check their website to see if there are eligibility requirements you must meet to qualify.

All D-SNP plans help you coordinate your Medicaid benefits. They work best when you’re enrolled in the same company’s HMO or managed care organization for Medicaid. That way, the same company provides both your Medicare and Medicaid coverage.

If you’re already enrolled in a Medicaid HMO or managed care organization, you can consider joining your organization’s D-SNP to coordinate your benefits.

If you’re not already enrolled in a Medicaid HMO or managed care organization, you may be able to join one. View the “Where can I get help?” section of this page for resources you can use to learn about your Medicaid options.

D-SNPs have little or no costs for health care and prescription coverage. Your costs depend on what Medicaid program you have and which D-SNP plan you choose. You can determine your costs by:

- Calling the plan.

- Checking Medicare.gov.

- Checking the plan’s website.

Yes, but you can only change your Medicare plan during certain times of the year. View the “Where can I get help?” section of this page for resources to help you determine when you can change your plan.

How do I enroll?

If you choose a D-SNP plan, there are several ways to enroll, including:

- Calling the plan in which you want to enroll (remember that not every D-SNP plan is available in every region).

- Using Medicare.gov.

- Calling Medicare at 800-633-4227.

You may only be able to enroll at certain times of the year.

You can also see the “Where can I get help?” section of this page for more resources to help with enrollment.

If you’re enrolled with an SSI Medicaid HMO and getting Medicare for the first time, you may be enrolled with a Medicare D-SNP offered by the same HMO you currently have for your Medicaid. This is called “default enrollment.” The letter should explain what is changing with your health insurance.

Examples of the default enrollment notices for SSI Medicaid (PDF) and Family Care Partnership members (PDF) are available.

Where can I get help?

If you need help or have questions about Medicare, contact the State Health Insurance Assistance Program by calling:

- The Medigap Helpline (800-242-1060)—a toll-free helpline run by the Wisconsin Board on Aging and Long-Term Care that provides counseling services for Medicare members.

- Judicare Legal Aid (800-472-1638)—a nonprofit law firm that provides legal assistance to those who couldn’t afford it otherwise.

- The Office for the Deaf and Hard of Hearing (262-347-3045)—benefit specialists who help people who are Deaf, hard of hearing, or Deaf-Blind understand and apply for benefits.

- Medicare at 800-MEDICARE (800-633-4227) or by visiting Medicare.gov.

Benefit specialists can also give you free advice about benefits. Find a benefit specialist using our "Find a Benefit Specialist" webpage.

You can call Member Services at 800-362-3003.

You can also visit our Medicaid member information webpage.